Is the Merced Housing Market Going to Crash?

![]()

Will the Merced Housing Market Crash, or Hold Steady? A Seller’s Guide

If you’ve been watching the headlines, you’ve probably seen the words “housing crash” pop up again. But how much of that applies to Merced County—and what should you really expect if you’re planning to sell in Merced, Atwater, or McSwain?

Let’s look past the noise and into the real data shaping your local market.

What Are Merced Prices Doing Right Now?

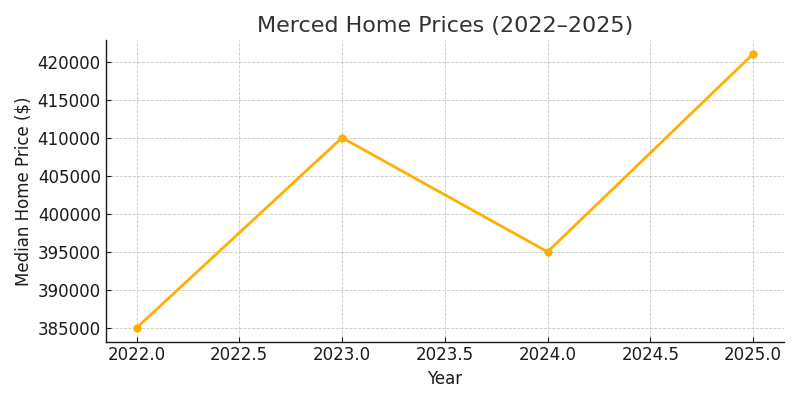

According to Redfin (Oct 2025), Merced’s median sale price sits near $420,000, up about 4 to 5 percent year-over-year.

In Merced County overall, homes are selling around $435,000, with the average time on market about 48 days.

That’s slower than the 2021 boom—but far from a collapse. A healthy market typically balances between 45 and 60 days on market, and that’s exactly where Merced sits today.

Zillow’s Home Value Index shows a near-flat trend this year, which aligns with a “cooling” phase—not a crash.

Do Listing Prices Suggest Weakness or Stability?

On Realtor.com, the median listing price in Merced hovers around $418,000—essentially flat from last year. At the county level, the median listing is around $440,000, down just 4 percent year-over-year.

That’s price resistance, not free-fall. Sellers who list clean, well-presented homes are still seeing strong offers within a month.

Are Foreclosures or Delinquencies Signaling a Crash?

Not even close. According to ATTOM Data Solutions, foreclosure filings in California remain below pre-pandemic averages, and delinquency rates statewide are under 2 percent.

Nationally, mortgage delinquencies hover near 3 percent—historically low levels.

That means there’s no wave of distressed sales coming to flood the market.

So, while affordability challenges have slowed buyer traffic, there’s nothing resembling a 2008-style crisis.

How the “Lock-In Effect” Supports Home Values

Many Merced homeowners refinanced during 2020–2021 when rates dipped below 3 percent. Now, with rates around 7 percent, those owners have little incentive to sell and take on a higher mortgage.

That limited inventory is exactly what’s keeping home prices stable.

As the Federal Reserve Bank of Philadelphia put it, the lock-in effect “reduces listings and cushions price declines”—and that’s playing out right here in Merced County.

Could Interest Rates Shift Demand in 2025?

Experts from NAR and Reuters expect 30-year mortgage rates to stabilize near 6 percent by mid-2025.

When rates ease, we usually see a surge in buyer demand, especially in Central Valley markets like Merced where affordability is still better than in the Bay Area.

That means timing your sale to coincide with those rate dips could help you capture multiple-offer momentum again.

What Would a Real “Crash” Look Like—And Are We Close?

A housing crash typically means home values dropping 20 percent or more, high inventory, and spiking foreclosures. None of that is happening here.

Right now, inventory in Merced County is below normal levels, foreclosures are scarce, and prices have moved modestly but positively.

If anything, Merced’s market is in a balanced correction phase, not a crash trajectory.

How Are Atwater and McSwain Performing?

- Atwater: The median sale price is around $425,000, up 2–3 percent YoY.

- McSwain: Luxury properties average around $930,000, up nearly 10 percent YoY (Redfin & Realtor.com data).

McSwain’s larger estates and acreage homes remain especially resilient because they attract relocation buyers and professionals looking for more space and privacy.

These buyers are less rate-sensitive, often purchasing with strong equity or cash.

What Should Sellers Do Right Now?

If you’re considering selling in 2025, focus on control what you can—and market smarter than your competition.

- Price intentionally. Slightly under market can spark competition and create emotional bidding.

- Stage for aspiration. Today’s buyers shop emotionally—neutral palettes, lighting, and texture matter.

- Offer flexibility. A 2-1 rate buydown or closing-cost credit can widen your buyer pool.

- Time the launch. Mid-April remains the sweet spot for Merced County listings.

- Maximize exposure. Pair professional photography with AI-powered digital campaigns for precision targeting.

How My AI-Certified Strategy Reduces Uncertainty

I’m Monica Franks, your local REALTOR® and AI Certified Agent.

That certification allows me to use cutting-edge tools that identify who’s most likely to buy your home, when they’re active, and how to reach them.

My AI-driven system analyzes buyer behavior, social media engagement, and timing patterns to ensure your home gets top-tier visibility across platforms like Google, Instagram, and Realtor.com.

In a shifting market, that’s not a luxury—it’s an advantage.

The Bottom Line: No Crash—Just a Smarter Market

Merced County’s housing market isn’t crashing. It’s correcting after record-breaking years, and that’s healthy.

Sellers who understand timing, presentation, and buyer psychology will continue to sell well above average.

So, if you’ve been waiting for a “safe” time to sell—this is it. Just make sure your home hits the market with strategy, not guesswork.

Thinking about selling? Now’s the time to position your home strategically so you don’t leave money on the table. I’ll walk you through exactly how to price, prep, and market for the best results—without the stress.

Call me at 209-345-3836 or DM me to talk strategy. I’m the SELLER’S Agent. Who You Choose Matters.

Frequently Asked Questions

Q: Is a Merced housing crash likely in 2025?

A: No. Local data shows stability: limited inventory, low foreclosure activity, and modest appreciation—all signs of balance, not collapse.

Q: What could change the outlook quickly?

A: A sudden rate spike or job-loss wave could pressure prices. But economists expect gradual stabilization around 6 percent mortgage rates instead.

Q: Are luxury homes in McSwain safer investments?

A: Yes. They attract equity-rich and relocation buyers who are less dependent on financing swings.

Q: What’s the best season to list?

A: Spring remains strongest—especially mid-April—but fall can perform well with less competition.

Q: Should I cut price or offer a rate buydown?

A: A temporary rate buydown often provides better results—it keeps your list price firm while improving affordability for buyers.

![]()